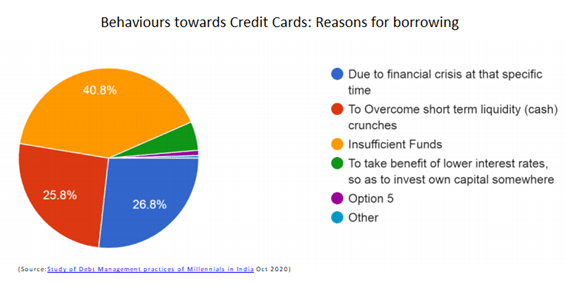

‘Insufficient funds’ have been cited as the top reason for swiping a credit card. Yes, credit cards do solve the issue of short-term liquidity crunches, but what about the long run?

Do you have the capacity to repay your ‘easy loan’ without dipping into your savings?

Remember! Curtailing expenses is the first step towards saving.

Household savings as a percentage of GDP in India have dropped from 23.5% in 2005 to 19.6% in 2015 and further to 18.2% in 20192.

How much time do we truly spend on keeping a tab on our expenses?

The graph above speaks volumes; it points out how Indian Millennials are more likely to use credit cards as an emergency fund. This is precisely why we need to take a closer look at how we spend our hard-earned money. A simple emergency fund could assist you in times of financial crunches and save you from the burden of debt and payable interest. On the other hand, an intelligent investor would use a credit card as a powerful tool to gain access to easy capital or save on interest payments, not vice-versa.

Yes, personal finance is ‘personal’ and is a boring topic. Tracking expenses periodically can seem like a burdensome task. But, these tiny steps in the right direction today can save you from a financial crisis in the future.

Making money is easy; making it last is difficult.

There are ample instances to cite where wealthy million and billionaires have gone bankrupt due to their casual attitude towards saving and spending. To save you from going down the same path, you could consider two avenues while managing your expenses. Most people follow a ‘budget’ while others ‘track their expenses’ to achieve their money goals. Here is how the two work:

Budgeting

Budgeting can often be construed as ‘spend shaming’, where you are coerced to feel bad about what you spend. The act of budgeting need not be a task that stops you from spending in its entirety; it is merely a method to help you prioritize your expenses between needs and wants.

A budget sets challenging targets for your expenses. It is a way of planning your expenses for the future and a method to maintain discipline in saving and investing. When unplanned expenses arise, budgets tend to go for a toss. This is why the need for an emergency fund occurs. It safeguards you from unforeseen substantial expenditures in times of medical needs, loss of income, etc. If you have questions on how to set up an emergency fund, here is an article that can help (TBNG Umbrella for a rainy day)

Creating budgets assists you on your journey to kick-start long-term financial plans as well. Setting a robust strategy that ensures your income is clearly divided into buckets for expenses, savings and investments set you on a path to financial independence. The more disciplined you are in staying on track of your planned expenditures; the more likely you are to achieve your set long-term financial goals.

How budgets help:

- You gain control over your income and expenses

- It helps you control your debt

- Reduces impulse spending

- Guides you to focus on your financial goals

The benefits of creating budgets are manifold, but above all, it simplifies your financial journey and gives you enough clarity to know how well your hard-earned money is working for you.

Tracking

Keeping a track of your expenses is another avenue people choose to manage their money. It is best suited if you are disciplined at saving and investing. Tracking does not include creating strict budgets for expenses, but it does involve keeping a tab on all expenses over a period of time.

In essence, your expenditure will be governed by ballpark figures set for every expense. But your discipline will give the fluidity to manage or balance the payments each month and ensure you do not overshoot your budget as a whole.

Tracking is comparatively tedious and time-consuming than budgeting. You could create a spreadsheet or use an app that suits you best to list your monthly outgoings. Tracking requires data of at least 3 to 6 months for you best to make sense of your average expenses and money behaviour. You will need to stay on top of your expenses and duly list your outgoings. But, since it is less rigid, it allows you the space to manage your finances prudently.

How tracking helps:

- It helps organize your finances

- It motivates you to cut back on discretionary spending

- Captures minor expenses that are often missed out

- Highlights your money management pitfalls

Keeping track of your expenses can be tough to begin with, but if you firmly follow the process, it gets ingrained like any other habit. It will help organize your finances and safeguard you from debt overload.

Yes, we understand personal finance is ‘personal.’ How you choose to manage your money is your call. So, pick a method that suits you best, but stick to it; because how you put your money to use will determine your financial status in the future.

If you are still struggling with managing your money reach out to our experts on info@tbng.co.in