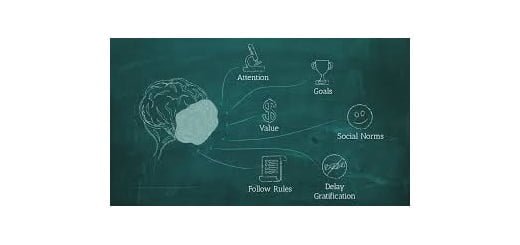

Usually decisions are made based on two pillars: beliefs and values. A decision maker’s values reflect his or her sense of what to strive for or to achieve, including goals and objectives. A decision maker’s beliefs are a reflection of his or her perceptions of reality, including facts, opinions, and uncertainties surrounding them. I believe that value and beliefs should be based on realistic scenarios and facts instead of emotions and psychological biases.

For example

As human beings we make, probably, thousands of decisions every single day. We deliberate between different outcomes, weigh the pros and cons, and sometimes compile lists. Decisions that require self-control are extremely important, as they directly affect a person’s bodily, social, or financial welfare.

Due to Availability bias, after seeing several news reports about short term volatility and fluctuations in the markets, you might make a judgment that the stock you own will not deliver the results in the time horizon you had planned to stay invested in.

As a result of Bandwagon Effect, when we rely too heavily on social information — listening to what our neighbors and friends say or do — we slowly begin to ignore our instincts and become a part of the breed of herd investors.

We have cultivated various misconceptions about the financial markets and investments. The crux of the matter is our beliefs and misunderstandings that stray us away from maximizing wealth creation. We have pre-conceived notions that disaster is always lurking just beneath the surface, ready to drag down unsuspecting investors. In fact, the stock market remains one of the most effective places to invest and has always risen despite frequent episodes of turmoil.

As Warren Buffett said, “We don’t have to be smarter than the rest. We have to be more disciplined than the rest.”Decision-making is in the locus of our control. We have the power to break patterns of behavior simply by making better decisions. The truth is it’s very rare for humans to make a genuinely logical, rational decision. Science can and should help decision makers by shaping their beliefs and values.

Thinking Man Advice:

- A brief period of mindfulness will help you tackle psychological biases hands on.

- Stick to the facts and disregard any prejudices you have already formed.

- Clarify the problem by collecting relevant data and do not rely on rumors and unverified news.

- Be persistent and consistent with your investments.