Imagine a world free of debt. Even the mere idea of being debt-free can be so liberating. Debt is not only a burden financially; it can also be mentally taxing to know that you have to repay a loan for many years to come.

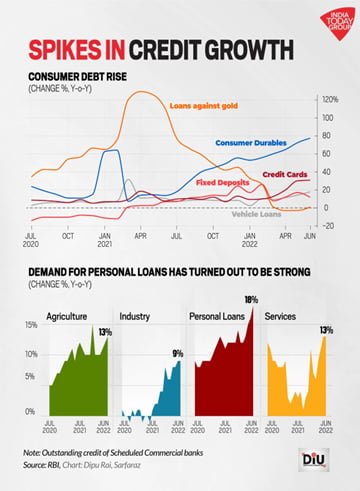

According to SBI research, India’s household debt increased significantly, from 32.5% in the fiscal year 2020 to 37.3% in 2021.

How deep are you in debt?

Can you imagine paying off your home loan, car loan, credit card debt, and any other debt you have more quickly than anticipated? If your answer is no, then this article is for you.

The truth is that there are a few strategies and actions you can take right now to lessen the debt you are carrying. Although these clever strategies won’t significantly and negatively impact your finances, they can effectively lower the total amount of interest payable over your loan’s life while speeding up your journey toward a debt-free future. Large-ticket purchases that carry a significant interest charge include real estate investments, luxury goods like cars, and substantial investments like overseas education. High-interest rates and heavy monthly EMIs come as a package deal with such significant investments. Making the repayment term shorter and paying less interest are two ways to pay off debt more quickly.

But before you proceed to use all of your financial resources to pay off your debts, make sure that you have crossed off the following two critical checkboxes:

Have an emergency fund?

A minimum of 6 to 8 months’ worth of expenses should be saved up. Therefore, if you have a surplus and intend to pay off your debt, be sure first to establish an emergency fund.

Have comprehensive insurance?

Life and its uncertainties must always be planned for and covered with proper insurance. Make sure everyone in your family and dependents has enough life, health, and disability insurance. You can now move forward to pay off your debt since your necessities are covered and secured.

The next step is to chart your critical goals and debts meticulously. For instance, it might be wise to keep investing in the goal rather than concentrating on paying off your debt, if you are at a point in your life where you are getting close to your child’s goal of attending college in the US but haven’t yet amassed the necessary financial resources. Therefore, it is crucial to jot down your important objectives while keeping track of your debts to understand your priorities better.

Once your priorities in terms of financial goals are clear the next steps include listing down your debts or loans. This step needs to be done meticulously on an excel sheet with latest information as mentioned below for each outstanding loan:

- Type of loan

- Outstanding balance (define principal and interest balances)

- Payment information (past and current)

- Loan Tenure

- Percentage of Interest

- EMIs due and due dates

- Restriction on loan repayments (if any)

Now, there are multiple methods of approach here that can be undertaken.

You could choose to filter your debts by tackling and clearing higher value loan amounts, higher tenures or higher interest rates. Here is where it can get a little tricky and hence a clear understanding of your debts and its clauses is required.

Highest Interest First

Paying high interests can eat into the value of your asset in the short run. You could choose to clear high interest rates loan first by investing lumpsum or surplus cash in these loans. Alternatively, a quick market check could give insight on how you could switch high interest rates loans to lower ones. For instance, a home loan at a higher fixed rate of interest could be shifted to a lender offering a lower rate of interest. Or a personal loan that charges 11% and upward on interest could be cleared by taking on a secured gold loan that charges a lower interest of approx. 7.5%.

Highest Tenure First

Choosing to clear loans based on tenures can be a bit tricky and will require in depth information about each loan. For instance, you could choose to pay off a 15year home loan first from which you have completed 8 years of EMIs. But there’s a catch: you’ve probably already paid the lender the majority of the interest if you’ve completed more than half of the tenure. You could instead check the next highest tenure in your outstanding debts and weigh it for benefits and downsides of prioritising and clearing that loan first. Keep a keen eye on restrictions on repayment too as certain loans have clauses on prepayment or early loan closures.

Lowest Value First

Human nature makes us crave success and highs. Finishing a task that has been long pending on your to do does bring a sense of accomplishment. Similar to how these numerous successes motivate us to handle the more challenging tasks, is the approach of first tackling the lower hanging fruits; in this case they are the low value loans. Debt from recent credit cards, low-value personal loans, etc. Paying these off can inspire you to move forward and pay off your debts more quickly.

A Trap or Tool

The pandemic and the cash crunch that came with it has entangled people in the web of debt. This scenario coupled with rising inflation post pandemic and easy access to credit with attractive offers like BNPL for products you cannot immediately afford too are further causing households to dive deeper into debt.

There is no denying that credit can be one of your most valuable financial tools if used skillfully and wisely both in business and personal finance. However, it can also prove to be a fatal trap for those who lack boundaries and discipline. Ensure you make informed decisions when it comes to debt, and if you need help, get in touch with one of our professionals for their expert advice.