Investing in the financial market can be daunting, with its inherent volatility and uncertainty. Many investors are unsure how to navigate the market’s ups and downs and make sound investment decisions. The temptation to time the market, that is, to buy or sell investments based on short-term market fluctuations, can be powerful. However, timing the market can be risky because it involves attempting to predict the market’s future movements, which are inherently unpredictable. Incorrect decisions can result in missed opportunities and potential losses.

Fortunately, there are investment strategies that can assist investors in mitigating the risks of market timing and making more informed investment decisions. Two popular strategies are Rupee Cost Averaging (RCA) and Value Averaging. Rather than trying to time the market, these strategies are based on the principle of investing consistently over time. In this article, we will delve into these strategies and understand how they work, as well as provide examples to demonstrate their effectiveness in managing market risks and potentially increasing returns.

1. Rupee Cost Averaging (RCA):

Rupee Cost Averaging (RCA) is a smart way to invest regularly by investing a fixed amount of money at regular intervals, just like a savings plan. It helps you spread out your investment over time, so you don’t have to worry about market ups and downs. When the market is down, your fixed investment buys more units, and when the market is up, it buys fewer units. This way, your average cost per unit of investment evens out over time, which can benefit your long-term investment growth.

Let’s consider an example to understand RCA better.

Suppose Mr. Sharma wants to invest in a mutual fund with a monthly investment amount of Rs. 10,000. Instead of investing the entire amount at once, he decides to use the RCA strategy and invest Rs. 10,000 every month for 6 months.

Month 1: Mr. Sharma invests Rs. 10,000 when the Net Asset Value (NAV) of the mutual fund is Rs. 100, and he gets 100 units of the mutual fund.

Month 2: The NAV drops to Rs. 90, and Mr. Sharma’s Rs. 10,000 investment now gets him 111.11 units.

Month 3: The NAV increases to Rs. 110, and Mr. Sharma’s Rs. 10,000 investment gets him 90.91 units.

Month 4: The NAV drops to Rs. 98, and Mr. Sharma’s Rs. 10,000 investment now gets him 102.04 units.

Month 5: The NAV increases to Rs. 100, and Mr. Sharma’s Rs. 10,000 investment gets him 100 units.

Month 6: The NAV remains at Rs. 100, and Mr. Sharma’s Rs. 10,000 investment gets him another 100 units.

In total, Mr. Sharma has invested Rs. 60,000 over 6 months and accumulated 604.06 units of the mutual fund through RCA. The average NAV cost per unit totals Rs. 99.32 (Rs. 60,000 divided by 604.06 units).

Advantage:

The advantage of RCA is that it allows Mr. Sharma to buy more units when the NAV is lower, and fewer units when the NAV is higher. This helps to average out the cost per unit and potentially reduce the impact of market volatility on his investment. By investing regularly over time, Mr. Sharma avoids the risk of making a lump sum investment at an unfavorable market timing and potentially benefits from averaging out the market fluctuations in the long run.

2. Value Averaging:

A Value Averaging strategy is one in which investors adjust their investment amount based on the performance of the investment. Simply put, Value Averaging is a strategy where investors change how much they invest based on how well their investments are doing. They set a goal for their investment and adjust how much they put in regularly based on that goal. If their investment is worth less than the goal, they invest more; if it’s worth more, they invest less. This way, they buy more units when the investment is worth less than the goal and fewer units when it’s worth more, helping to balance things out over time.

Let’s consider a similar example to understand Value Averaging better.

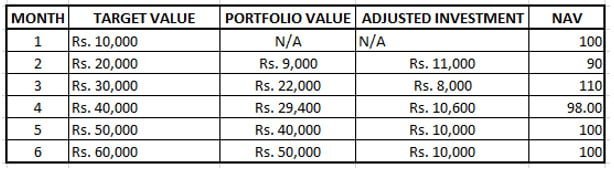

Suppose Ms. Sharma sets a target value of Rs 60,000 for her investment and starts with an initial investment of Rs 10,000. Over six months, the value of her investment fluctuates as follows:

Month 1: In this example, Ms. Sharma starts with an initial investment of Rs. 10,000. However, the portfolio value drops to Rs. 9,000 by the end of the first month, below her target value of Rs. 10,000.

Month 2: As per the value averaging strategy, she adjusts her investment for the second month to Rs. 11,000 to meet her target of Rs. 20,000.

Month 3: In the third month, her portfolio value declined to Rs. 22,000, and she invested Rs. 8,000 instead of the planned Rs. 10,000 to meet her target of Rs. 30,000.

Month 4: In the fourth month, her portfolio value drops to Rs. 29,400, and she invests Rs. 10,600 to meet her target of Rs. 40,000.

Months 5&6: In the fifth and 6th months, her portfolio value remains consistent at 40,000 and 50,000, so she invests Rs. 10,000 each month to meet her target of Rs. 50,000 and Rs. 60,000, respectively.

Similarly, she would continue adjusting her investment amount in subsequent months based on the performance of her portfolio to meet the monthly target values she sets.

Advantages:

Value averaging promotes disciplined investing by providing investors with a systematic approach to follow regardless of market conditions. It assists investors in staying focused on their investment objectives and avoiding rash investment decisions based on short-term market movements. Overall, Value Averaging can be a beneficial strategy for investors seeking a disciplined approach to managing their investments and potentially optimizing portfolio performance over time.

Conclusion

In conclusion, Rupee Cost Averaging (RCA) and Value Averaging are two effective strategies for long-term investing in the stock market. RCA helps investors average out the cost of investment over time, reducing the impact of market volatility. It allows investors to consistently invest a fixed amount at regular intervals, regardless of the market’s performance. On the other hand, Value Averaging helps investors adjust their investment amount based on the performance of the investment, allowing them to buy more units when the investment is below the target value and fewer units when it is above the target value.

Both strategies can provide investors with a disciplined approach to investing and help them navigate the ups and downs of the market. It’s important to understand these strategies and choose the one that aligns with your investment goals, risk tolerance, and time horizon to make informed investment decisions for long-term wealth creation. As with any investment strategy, consulting with a qualified financial advisor and conducting thorough research is recommended before implementing RCA, Value Averaging, or any other investment approach. Happy investing!